The Top Functions to Search For in a Secured Credit Card Singapore

The Top Functions to Search For in a Secured Credit Card Singapore

Blog Article

Exploring Options: Can Former Bankrupts Secure Credit Report Cards Following Discharge?

One common concern that occurs is whether previous bankrupts can successfully acquire credit score cards after their discharge. The response to this query includes a complex exploration of various variables, from credit rating card choices tailored to this demographic to the effect of previous financial choices on future credit reliability.

Recognizing Charge Card Options

When taking into consideration credit cards post-bankruptcy, people should very carefully analyze their needs and financial scenario to select the most ideal alternative. Secured debt cards, for instance, need a money deposit as security, making them a viable selection for those looking to restore their credit report history.

In addition, people must pay close attention to the annual percent rate (APR), poise period, annual costs, and benefits programs offered by various credit report cards. By comprehensively examining these elements, individuals can make informed choices when choosing a credit report card that aligns with their economic goals and situations.

Variables Affecting Authorization

When getting charge card post-bankruptcy, understanding the aspects that influence authorization is important for people looking for to restore their financial standing. One crucial variable is the applicant's credit history. Following a personal bankruptcy, credit report typically take a hit, making it harder to get approved for conventional charge card. However, some issuers offer safeguarded charge card that need a deposit, which can be a much more attainable choice post-bankruptcy. An additional significant variable is the applicant's earnings and employment standing. Lenders intend to ensure that individuals have a steady earnings to make timely repayments. In addition, the size of time since the personal bankruptcy discharge contributes in authorization. The longer the period because the insolvency, the greater the opportunities of approval. Showing liable economic behavior post-bankruptcy, such as paying expenses on schedule and keeping debt usage reduced, can additionally positively influence bank card approval. Understanding these elements and taking actions to boost them can boost the probability of safeguarding a credit report card post-bankruptcy.

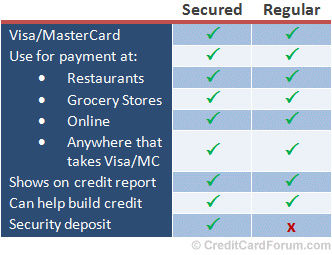

Safe Vs. Unsecured Cards

Comprehending the differences in between unsecured and secured credit cards is essential for people post-bankruptcy seeking to make enlightened choices on restoring their monetary health. Secured credit score cards require a cash money down payment as security, usually equal to the credit line extended by the provider. This down payment reduces the threat for the charge card firm, making it a feasible option for those with a history of insolvency or poor credit scores. Secured cards usually feature reduced credit score limits and higher rate of interest compared to unsecured cards. On the various other hand, unsecured charge card do not require a cash money deposit and are based only on the cardholder's creditworthiness. These cards usually use greater credit report restrictions and lower rate of interest prices for individuals with great credit rating scores. Nevertheless, post-bankruptcy people may find it challenging to qualify for unprotected cards promptly after discharge, making safe cards a much more practical option to begin restoring credit report. Ultimately, the option between safeguarded and unsafe charge card relies on the individual's financial situation and credit report goals.

Building Debt Responsibly

To effectively rebuild credit post-bankruptcy, establishing a pattern of accountable credit rating use is crucial. One vital way to do this is by making timely repayments on all charge account. Repayment background is a significant variable in determining credit rating, so making certain that all bills are paid promptly can progressively improve creditworthiness. Additionally, keeping charge card balances low relative to the credit line can positively impact credit rating scores. secured credit card singapore. Experts recommend maintaining credit use below 30% to show responsible credit scores try these out management.

An additional strategy for building credit report sensibly is to monitor credit scores reports consistently. By reviewing credit history reports for errors or signs of identification burglary, people can address problems without delay and preserve the accuracy of their credit history.

Enjoying Long-Term Perks

Having look at this site actually developed a foundation of responsible credit history administration post-bankruptcy, individuals can currently focus on leveraging their enhanced credit reliability for lasting financial benefits. By regularly making on-time settlements, keeping credit scores usage reduced, and monitoring their credit history reports for accuracy, former bankrupts can slowly rebuild their credit report. As their credit history increase, they might end up being eligible for far better bank card uses with lower rate of interest and greater credit score limits.

Reaping lasting take advantage of improved credit reliability extends past just charge card. It opens doors to positive terms on financings, home loans, and insurance premiums. With a solid credit report, individuals can bargain much better rates of interest on fundings, potentially saving hundreds of dollars in rate of interest settlements in time. Furthermore, a favorable credit scores account can boost job prospects, as some employers might examine credit rating reports as part of the employing procedure.

Conclusion

To conclude, former insolvent people might have difficulty protecting credit cards following discharge, however there are choices readily available to aid rebuild credit history. Recognizing the various kinds of charge card, aspects affecting authorization, and the relevance of liable bank card usage can help individuals in this scenario. By choosing the ideal card and utilizing it properly, former bankrupts can progressively boost their credit rating and gain the long-lasting advantages of having accessibility to credit.

Demonstrating responsible economic behavior post-bankruptcy, such as paying click resources expenses on time and keeping credit report usage low, can likewise positively influence credit scores card approval. In addition, maintaining debt card balances low relative to the credit scores limitation can favorably affect credit history ratings. By continually making on-time payments, keeping credit usage reduced, and monitoring their debt records for precision, previous bankrupts can progressively rebuild their credit rating ratings. As their credit report ratings raise, they may come to be qualified for much better debt card uses with reduced rate of interest rates and higher debt restrictions.

Recognizing the different kinds of credit score cards, aspects affecting approval, and the significance of liable credit card use can assist individuals in this situation. secured credit card singapore.

Report this page